The real estate market in New York has always been a battleground of competition, but recent data reveals a significant shift in the dynamics of competition. As Manhattan and Nassau County see tighter competition due to limited inventory and high demand, developers are increasingly turning their attention eastward, particularly towards Suffolk County.

Tightening Markets in Manhattan and Nassau County

Manhattan continues to be one of the most competitive real estate markets in the world. The data from the past year paints a clear picture of this intensity. Manhattan’s residential market, characterized by a scarcity of new listings and a limited total inventory, has forced buyers into fierce competition. This extreme scarcity is characterized by a lack of supply (in a city of millions there are often fewer than 100 listings available on market, monthly) Every new listing is highly coveted, driving up prices and making it increasingly difficult for buyers to secure properties.

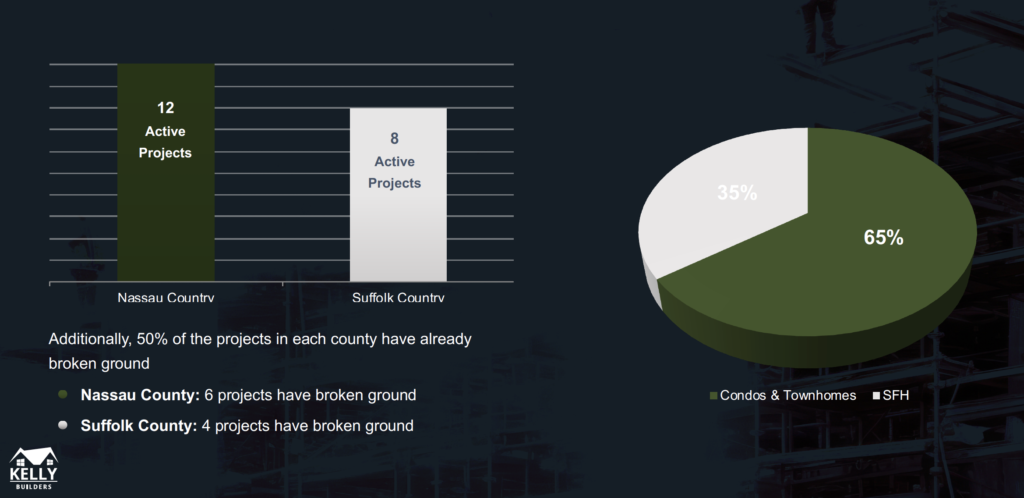

Nassau County, while not as constrained as Manhattan, is also experiencing heightened competition. With its proximity to New York City, Nassau has always been a desirable location for those seeking a suburban lifestyle with easy access to the city. The data from May 2024 shows 1,284 new residential listings and 1,986 total listings—numbers significantly higher than Manhattan but still indicative of a competitive market. Nassau’s market has been able to sustain this level of activity, but as demand continues to rise, developers are finding it harder to meet the needs of prospective buyers (LIBOR Market Statistics, 2024).

The Eastward Push

As the pressure in Manhattan and Nassau continues to mount, developers are increasingly looking eastward to Suffolk County. Suffolk’s real estate market, while traditionally less competitive, is now becoming a prime target for development. The data indicates that Suffolk County not only has a larger inventory but also shows a steady increase in new listings, particularly in the spring and summer months. For example, in May 2024, Suffolk County had 1,620 new residential listings and a total of 2,748 listings, making it a much more robust market in terms of availability. To put this into perspective, during the month of May, 41% of the available property in Suffolk County was remaining supply from previous months. Compared to Nassau county in the 30% range, and Manhattan even lower. Historically, surrounding high-growth cities, monthly turnover healthfully ticks around 1/3rd of available inventory. The more backed up supply, the more we see prices decreases.

Developers see Suffolk as a land of opportunity—a place where they can build to meet the growing demand that cannot be satisfied in the already crowded markets of Manhattan and Nassau. This trend is particularly evident in the rise of new construction projects, including the development of subdivisions and communities aimed at attracting both families and retirees looking for more space and a quieter lifestyle.

Suffolk: The New Frontier

Suffolk County’s appeal lies not only in its available land but also in its potential for growth. As developers push east, they are not just building homes but creating communities, complete with amenities that cater to the needs of modern buyers. These developments often emphasize sustainability, open spaces, and a balance between nature and convenience, which are increasingly important to today’s homebuyers.

As Suffolk becomes more developed, the market dynamics may begin to mirror those of Nassau and even Manhattan. The current influx of development might lead to a rise in property values, making Suffolk a more competitive market in the years to come. This trend not only reflects the changing demands of buyers but also signals a broader shift in how and where New Yorkers will choose live in the future.